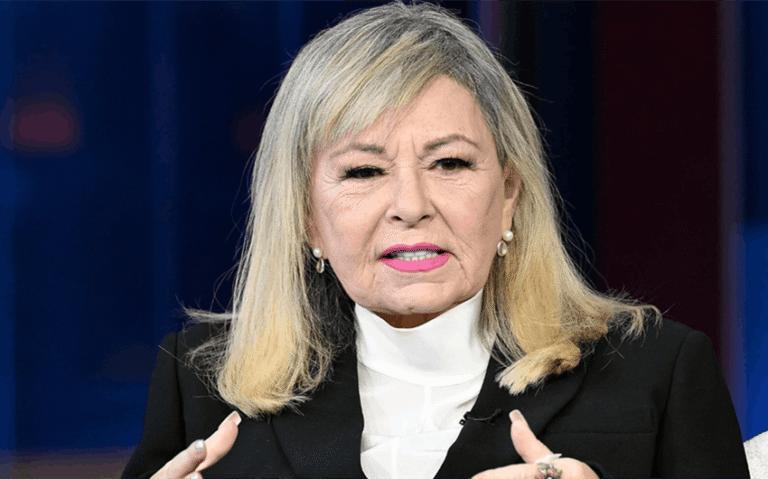

Mr. Wonderful Net Worth: How Kevin O’Leary Built His Estimated $400 Million Fortune

When people search Mr. Wonderful net worth, they usually want two things: a realistic estimate and a clear story behind it. The most common public estimates put Kevin O’Leary at around $400 million, though the exact figure can move with markets and private investments. What matters most is how he built that wealth—through a major software-era business win, years of disciplined investing, and a media career that keeps his deal pipeline full.

Who is “Mr. Wonderful” and why his wealth gets so much attention

Kevin O’Leary is best known today as the sharp, blunt investor on Shark Tank, where he plays the role of the tough-love businessman who doesn’t waste time on feelings. That persona is entertaining, but it also makes people curious. Viewers watch him slice through pitches, talk about margins, and argue over valuation, then naturally wonder: “Okay… how rich is this guy really?”

His wealth gets extra attention because it looks like it came from more than one place. Some people become rich from a single lucky break. O’Leary’s public career suggests a different path: one major early win that created momentum, followed by decades of investing and brand-building that kept money compounding. That kind of long-run wealth story feels repeatable, which is why people keep searching for it.

Mr. Wonderful’s net worth estimate and why it’s not a fixed number

Kevin O’Leary’s net worth is widely estimated at about $400 million. That number is best treated as a working estimate, not a precise scoreboard. Net worth is calculated by adding up assets (cash, investments, ownership stakes, property, and other valuables) and subtracting liabilities (debts and obligations). For high-net-worth investors, the biggest reason net worth “moves” is that many assets are tied to markets and business performance.

Here are a few reasons the estimate can vary from one website to the next:

- Private company values are not always public. If someone owns stakes in private businesses, outsiders are forced to estimate value.

- Investments rise and fall. A portfolio can swing with the stock market, interest rates, and industry trends.

- Deals have different structures. A business sale may include cash, stock, earn-outs, or performance-based payouts.

- Public reporting is incomplete. Even famous investors don’t publish a full balance sheet for the world to inspect.

So when you see $400 million, think “most commonly reported range,” not “exact number down to the last dollar.” That mindset keeps the conversation realistic.

The foundation: the software business that changed everything

The strongest “origin story” for Kevin O’Leary’s wealth traces back to the software industry boom years. Before he was a television personality, he was building and acquiring software products at scale. This is where the first major engine of his wealth came from—creating or controlling businesses that could be sold for large sums.

In the 1980s and 1990s, consumer software was exploding. Educational products, productivity tools, and bundles were selling in stores the way video games and electronics sell today. O’Leary became known for a business style that focused on distribution, packaging, and aggressive growth—methods that can look simple from a distance but are hard to execute well. He wasn’t just “making software.” He was building a machine for selling it.

Over time, that machine became a springboard into bigger opportunities. Whether you admire the approach or not, it’s clear that his early business life placed him in the right market at the right time—and he was willing to move fast when openings appeared.

The Learning Company and the Mattel acquisition: the big headline moment

One of the biggest milestones associated with O’Leary’s wealth story is the acquisition of The Learning Company by Mattel in 1999, a deal often reported in the billions. This is the moment many people point to when they say, “That’s how he got rich.”

It’s true that large acquisitions can create life-changing wealth. But it’s also important to understand how these deals usually work for founders and executives. A “deal value” number does not automatically equal the cash someone personally receives. Acquisitions can include stock, performance triggers, and layers of ownership. Still, even allowing for complexity, this era clearly helped O’Leary build a serious financial base that most people never get.

The practical takeaway is simple: a major exit can provide the capital and credibility that makes everything else easier. After a successful sale, you can invest more, take bigger swings, and attract higher-quality partners. In business, momentum is real—and major exits create momentum.

How television turned him into a business brand

O’Leary didn’t just become wealthy and then appear on television for fun. TV became a second engine of wealth because it transformed him into a brand. Being “Mr. Wonderful” isn’t just a nickname. It’s market position.

Once you’re recognizable, opportunities expand in a few important ways:

- More deal flow comes to you. Founders want the famous investor on their side.

- Your network grows faster. Media visibility brings introductions you wouldn’t otherwise get.

- You get paid for attention. Speaking, hosting, partnerships, and appearances can become meaningful income streams.

- Your negotiating power improves. A known name often has leverage in licensing and distribution conversations.

Even if you never know the exact dollar value of TV income, it’s easy to see how it increases the number of ways he can earn and invest. Fame, in his case, acts like a multiplier.

Shark Tank deals and why “small” investments can become big assets

On Shark Tank, viewers see deals like “$100,000 for 10%” and assume that’s a small, almost casual bet. But the real money is usually in what happens after the show. A company that survives and scales can multiply in value, turning a modest check into a serious asset.

O’Leary is also known for pushing deal structures that focus on cash flow, not just ownership. He often prefers arrangements like royalties or licensing fees, which can produce steady income as the product sells. This strategy fits his public personality: he likes clarity, predictability, and getting paid sooner rather than later.

Not every startup wins. In fact, many don’t. But portfolio investing doesn’t require every deal to be a home run. It only takes a few strong performers to justify a long list of average outcomes.

His investing mindset: cash flow, discipline, and rules

One consistent theme in O’Leary’s public approach is that he treats investing like a system. He talks about discipline, quality businesses, and the value of cash flow. Whether you agree with his specific picks or not, the mindset is a big reason people stay wealthy long-term.

Here’s what “system investing” tends to look like in real life:

- Diversification: Avoiding a situation where one bad event destroys everything.

- Repeatable criteria: Buying assets for reasons you can explain and repeat.

- Income focus: Favoring investments that return cash through dividends, interest, or royalties.

- Emotional control: Not panicking at every headline or market swing.

This kind of structure doesn’t sound exciting, but it’s how many high-net-worth people protect what they’ve built. It also helps explain how a big early win can turn into decades of continued growth instead of a one-time peak.

Business ventures beyond the camera

Kevin O’Leary’s wealth story doesn’t end with a single business sale or a television role. Over the years, his name has been tied to different ventures and investment activities that broaden his income sources. For wealthy investors, this “multiple bucket” approach is common because it spreads risk and creates stability.

Generally, his wealth is believed to come from a mix like this:

- Equity stakes in businesses (including startups and private companies)

- Public market investments (stocks and other securities)

- Media and appearance income connected to his public persona

- Books and speaking that monetize expertise and visibility

When you build money this way, you’re less dependent on any single source. A bad year in one area can be offset by strength in another.

Does he invest in crypto?

O’Leary has discussed cryptocurrency publicly and has been associated with crypto investing over the years. That tends to raise eyebrows because crypto can be volatile, and his brand is often built around “numbers first” caution. The key point is that wealthy investors frequently experiment with small slices of higher-risk assets, especially when they believe there’s long-term adoption potential.

For net worth estimates, crypto can add uncertainty because prices swing quickly. If someone holds a meaningful position, their net worth could look different depending on the day the estimate is made. This is another reason you’ll see variation across reports.

Real estate and lifestyle assets: what they can mean for net worth

Many high-net-worth individuals hold some wealth in real estate. Property can serve a few purposes at once: it can store value, generate rental income, and provide diversification away from stocks. While specific holdings are not always clearly documented for public figures, real estate is often part of the broader picture for someone in O’Leary’s financial tier.

Lifestyle assets—things like boats, collectibles, and luxury items—can also be included in net worth calculations, although those values are harder to estimate and easier to exaggerate online. The most reliable way to think about lifestyle assets is simple: they’re usually not the main driver of wealth. The real driver is ownership and investments.

Controversy, risk, and why wealth still survives mistakes

No wealthy investor has a perfectly clean, perfectly linear story. Business involves risk, and risk sometimes comes with controversy, criticism, or deals that don’t work out. What separates people who stay wealthy from people who flame out is usually not “never making mistakes.” It’s having a structure that prevents mistakes from becoming fatal.

That structure can include:

- Spreading bets across many investments instead of relying on one company.

- Maintaining liquidity so you can handle problems without selling everything at a bad time.

- Protecting reputation carefully because reputation affects deal access.

- Reinvesting intelligently instead of spending like the money will never stop.

This is one reason O’Leary’s estimated wealth remains high over time. The system matters as much as the wins.

What people can learn from the Mr. Wonderful net worth story

You don’t need to like Kevin O’Leary’s TV style to learn from the way wealth is built and maintained. His story highlights a few practical lessons that apply to business owners, investors, and anyone trying to grow financially:

- One big win can change your life, but only if you use it to build a long-term strategy.

- Visibility can be leverage when it leads to better deals and stronger networks.

- Cash flow is powerful because it gives you options and reduces stress.

- Discipline beats excitement when the goal is lasting wealth.

- Multiple income streams protect you when markets or industries slow down.

At the end of the day, the “Mr. Wonderful net worth” question is really about a bigger idea: how money grows when business, investing, and brand all reinforce each other. O’Leary built a career where each piece strengthens the next, and that kind of structure is hard to break.

If you’re trying to build wealth yourself, the best part of this story isn’t the headline number. It’s the blueprint: build something valuable, take smart exits when the moment is right, and keep your money working through disciplined investing and diversified opportunities.

image source: https://www.nexttv.com/news/mr-wonderful-on-new-show-money-court-old-show-shark-tank