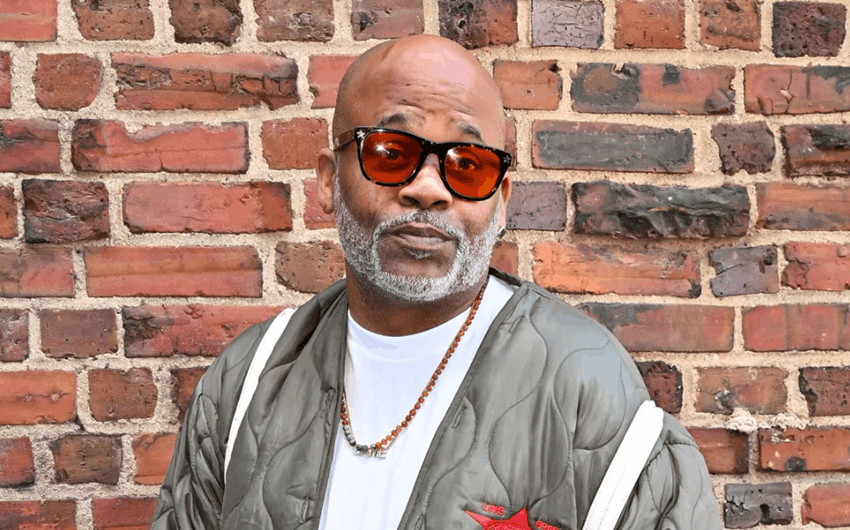

Dame Dash Net Worth in 2026: Bankruptcy, Roc-A-Fella Auction, and Debt Breakdown

Dame Dash net worth is no longer a “how rich was he at the peak?” conversation—it’s a “how deep did the damage go?” conversation. The short answer is that his net worth appears heavily negative today, because recent court records and reporting describe a Chapter 7 bankruptcy filing with minimal listed assets and tens of millions in reported debts. The real story is how a man who once helped build a hip-hop empire ended up in a financial reset shaped by taxes, judgments, and forced asset sales.

The clean snapshot: what his money looks like now

If you only remember Dame Dash as the Roc-A-Fella era power player, today’s numbers feel unreal. But the current picture is blunt. In widely reported bankruptcy documents, Dash is described as filing Chapter 7 and listing very little in assets while reporting more than $25 million in debt. That combination points to an overall net worth that isn’t just “down.” It’s underwater—the type of financial situation where obligations overwhelm anything that can be sold or earned quickly.

When people throw around random net worth guesses online, it helps to focus on what bankruptcy filings are actually saying. A filing like that doesn’t mean someone has zero earning ability forever. But it does mean the present-day balance sheet is crushed: the debts are real, and the court process exists because normal cash flow isn’t covering them.

Why this fall hits harder than most celebrity “money problems” stories

Most celebrity money stories follow a predictable script: big income, big spending, a few bad investments, and then a slow slide. Dame Dash’s story is rougher because it involves legal enforcement. That’s the difference between “I’m having a bad year” and “the system is collecting.”

Once court judgments and tax debts stack up, the money conversation changes. It’s no longer about lifestyle. It’s about priority. Courts decide who gets paid first. Creditors line up. Interest grows. And suddenly, even valuable assets become targets, because they’re one of the few ways the debts can be satisfied.

Back then, the empire was real

It’s easy to forget how powerful Dame Dash once was because the internet loves to freeze people in their latest headline. But at his peak, he was a true builder: Roc-A-Fella Records wasn’t a side hustle, and Rocawear wasn’t a cute brand drop. Those were serious businesses in a time when music, fashion, and culture were merging into a new kind of money.

Dash was part of a generation that helped prove hip-hop could be boardroom business, not just art. That’s why people still search his net worth. They’re trying to reconcile that era of influence with today’s financial reality.

What changed: the debt stack became the main character

Dame Dash’s financial situation didn’t collapse because of one single mistake. It collapsed because problems stacked in multiple directions at once. When that happens, your cash flow gets attacked from every side:

- Tax debt that doesn’t go away quietly and can trigger aggressive collection efforts

- Domestic support obligations that courts take seriously and prioritize

- Civil judgments that can turn into long-term financial anchors

- Legal fees that drain resources even before you lose a case

- Reputation and deal access shrinking your ability to raise money or partner your way out

This is why his net worth is such a moving target in the public conversation. People try to measure “what he owns,” but they ignore “what is owed.” Net worth is assets minus liabilities. When liabilities explode, it doesn’t matter how legendary your résumé is—the math turns cold.

The Roc-A-Fella stake auction: when legacy becomes collateral

The most symbolic moment in Dame Dash’s money story is the forced sale of something tied to his legacy: his stake connected to Roc-A-Fella. For years, that ownership represented status. It represented history. It represented “I helped build this.”

But when debts become enforceable, legacy becomes collateral. Reporting has described how New York State purchased Dash’s one-third stake at a federal auction for $1 million as part of efforts tied to back taxes. That detail matters because it shows the shift in real terms: a piece of one of hip-hop’s most famous labels was treated like a collectible asset that could be grabbed, sold, and used to pay down what he owed.

And here’s the part people miss: even when an asset sells, it doesn’t mean the problem is solved. A big debt stack doesn’t vanish because one asset got liquidated. It’s more like scooping a cup of water out of a flooded basement. It helps, but the structure is still underwater.

The bankruptcy filing: the “reset button” that comes with consequences

When someone files Chapter 7, it usually means the old strategy is finished. No more juggling. No more delaying. No more pretending a new deal will fix everything. Chapter 7 is liquidation territory—an admission that the current situation can’t be managed through normal means.

In the reporting around Dash’s filing, the details are striking: debts north of $25 million, very minimal listed personal assets, and claims of no monthly income at the time of filing. Whether or not someone truly has “no income” in the broader sense, that claim speaks to the immediate reality the court is looking at: what can be collected, what is documented, and what is available right now.

Bankruptcy also doesn’t magically erase everything. Certain obligations—especially domestic support—carry serious weight. And even when debts are discharged, the reputational impact and the practical rebuilding process can take years.

So what is Dame Dash’s net worth in 2026, realistically?

If you want a straight answer that matches the public record and the logic of net worth:

Estimated Dame Dash net worth in 2026: roughly -$20 million to -$25 million (negative), based on widely reported bankruptcy debt figures versus minimal listed assets.

That range isn’t meant to sound dramatic. It’s simply what happens when reported liabilities are massive and reported assets are tiny. If you’re carrying $25 million in debts and you’re listing only a few thousand dollars in assets in a bankruptcy filing, your net worth is not “low.” It’s deeply negative.

Why the internet keeps publishing random numbers anyway

Some sites still float small positive net worth estimates because the internet loves a neat number. But Dame’s situation doesn’t fit neat math for three reasons:

- Private assets aren’t always visible: the public does not see every business interest or agreement.

- Debt is often clearer than ownership: judgments and tax claims are documented, while the value of private ventures is harder to price.

- Income is not net worth: someone can still hustle and earn while being financially underwater.

That last point is key. Dame Dash can still be active, still be loud, still do interviews and projects—and still have a net worth that’s negative. A person’s energy doesn’t cancel out a debt stack.

How he can still make money (even with a negative net worth)

Here’s what’s important for readers who want the full picture: net worth is not the same thing as “ability to earn.” Even people in serious financial trouble can generate income. The difference is how much of that income actually stays with them after obligations are enforced.

Dame Dash’s potential income lanes, in simple terms, look like this:

- Media and appearance work: interviews, speaking, and paid participation tied to his cultural profile

- Independent ventures: new businesses, small brand partnerships, and projects built on his name

- Content-driven monetization: using attention to sell products or memberships

- Licensing and legacy opportunities: when his history gets packaged into documentaries, series concepts, or IP deals

But the catch is obvious: when debts and legal claims exist, income can be redirected. That’s why rebuilding isn’t only about “making money.” It’s about making money in a way that survives collection efforts, satisfies obligations, and restores credibility.

The real lesson of his net worth story

Dame Dash’s financial arc is a reminder that cultural power and financial stability are not the same thing. He helped shape an era and still ended up in a place where courts and tax authorities became central characters in his money story. That doesn’t erase what he built. It simply proves that building something iconic doesn’t automatically protect you from the consequences of debt, litigation, and years of financial pressure.

When you hear “bankruptcy,” it’s easy to reduce the story to a punchline. The more honest view is this: bankruptcy is often the final stage of a long fight to stay afloat. For Dame, that fight played out publicly—through lawsuits, auctions, and headlines—until the reset became unavoidable.

Bottom line

Dame Dash net worth in 2026 appears strongly negative, with reporting around his bankruptcy describing minimal listed assets and more than $25 million in debt. If you want one confident takeaway: he went from ownership-era empire building to a court-driven financial reset. The legacy is still real, but the balance sheet is brutally clear.

image source: https://www.billboard.com/music/rb-hip-hop/dame-dash-drake-roc-a-fella-shares-1235833670/