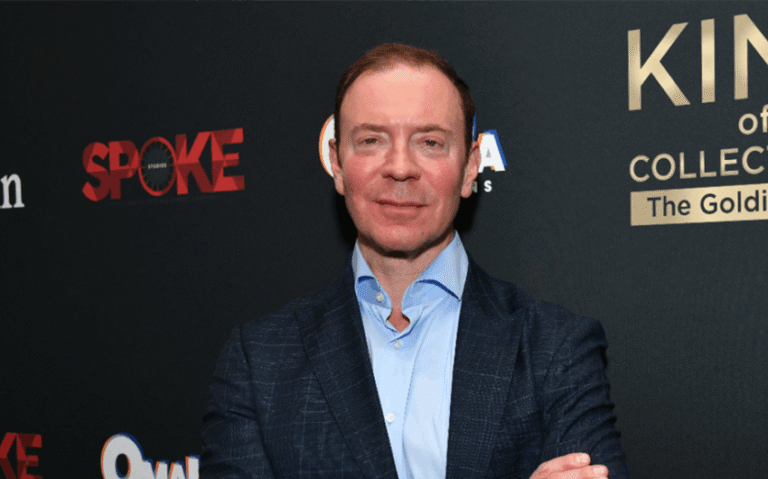

Jamie Siminoff Net Worth in 2026: Ring’s Billion-Dollar Exit and Second Act

Jamie Siminoff net worth is one of those searches that really means, “How much did the Ring founder actually walk away with?” The confident answer is that he’s widely estimated to be worth around $300 million (often cited in a $300–$400 million range), thanks to Ring’s reported billion-dollar sale, the equity he kept along the way, and the fact that he never stopped building after the headline moment.

Why his money story hits differently than most tech founders

Plenty of founders sell a company and disappear into a quiet life of investing. Siminoff didn’t. His story keeps looping back into the center of the smart home world because he treats success like a checkpoint, not an ending. He built a product that became a category, survived a very public rejection, pushed through a near-broke stretch, sold at the right time, and then returned to the exact arena he helped create.

That rhythm matters for net worth. It suggests two things: he likely did very well from the Ring deal, and he has continued to earn through executive roles, board work, and new ventures that keep his financial floor high even years after the acquisition.

So, what is Jamie Siminoff’s net worth right now?

Let’s put the number on the table the way readers want it:

Estimated Jamie Siminoff net worth in 2026: about $300 million (with many public estimates placing him in the $300–$400 million range).

No public figure like this has a fully verified, itemized balance sheet available to readers. But this estimate lines up with the known scale of Ring, the reported acquisition price, and the reality that founders who retain meaningful equity through a major exit can end up with life-changing wealth even after taxes, dilution, and years of operating costs.

The “Shark Tank reject” chapter wasn’t a detour—it was the origin story

Siminoff’s Ring story started as Doorbot, a smart doorbell idea that felt obvious only after it worked. When he pitched it on Shark Tank in 2013 and didn’t get a deal, the public takeaway was simple: the Sharks didn’t believe.

But the deeper takeaway is the one founders recognize immediately: the product-market fit was still loading. Early-stage hardware is brutal. It’s expensive, it breaks, manufacturing is unforgiving, and every delay burns cash. Rejection on TV wasn’t what threatened the company. The threat was the basic math of building physical devices without a giant balance sheet.

That’s also why his financial story later becomes so compelling. If you’ve ever tried to build hardware, you understand how rare it is to go from “I’m not sure we make payroll” to “I just sold to Amazon.” That swing is where the money narrative is born.

Ring’s reported $1 billion sale changed his life—and the whole smart home market

In 2018, Amazon acquired Ring in a deal widely reported at around $1 billion. On paper, that headline price makes people assume the founder instantly became a billionaire. Real life is more complicated.

Here’s what typically sits behind a deal like that:

- Founder ownership changes over time. Each funding round can dilute early shares.

- There are multiple shareholders. Investors, employees with equity, and early backers all take pieces.

- Taxes hit hard. Depending on structure, state residency, and timing, taxes can take a serious bite.

- Not all value is cash at close. Some deals include retention packages, incentives, or stock-based components.

Even after all of that, the founder of a company sold at that scale can still walk away extremely wealthy—especially if they held a strong stake through the acquisition. That’s why a $300 million estimate is not a wild number here. It’s the kind of result you’d expect from a successful exit where the founder stayed close to the business and kept meaningful ownership.

Why Ring kept paying even after the sale

The biggest misconception about a startup exit is that it’s one payday and then it’s over. For many founders, the exit is the beginning of a new kind of income.

After the acquisition, Siminoff didn’t vanish—he stayed involved. Founders who remain inside a large acquirer often receive ongoing compensation packages: executive salary, bonuses, and performance incentives that can be very significant, especially when the acquired business becomes a major division.

And Ring did become a major division. It wasn’t just a gadget. It was a gateway product that tied together home security, neighborhood awareness features, and a broader smart home ecosystem. When a founder remains attached to a business that stays strategically important, the earnings can continue for years.

The second act: leaving, building again, and returning to Amazon

Siminoff’s net worth story doesn’t stop at “sold to Amazon.” That’s where it gets interesting. After leaving Amazon the first time, he launched another startup, Honest Day’s Work, and later sold it to Latch (with the business rebranded as Door.com). That move matters because it shows he wasn’t simply living off the Ring win. He was still building companies that could sell.

Then he came back to Amazon in 2025 as a vice president, leading Ring and related smart home teams. That return signals two things at once: Amazon still believes he’s the right operator for that category, and Siminoff still sees the smart home space as worth his time. From a wealth standpoint, returning at that level likely means strong compensation and influence—plus a front-row seat to whatever the next wave of home security becomes.

AI is the new growth lever—and he’s positioning himself at the center of it

Smart home security used to be about recording video and sending alerts. The next phase is about interpretation: what’s happening, whether it matters, and what you should do about it. That shift is basically an AI story.

Siminoff has leaned into that “AI pivot” language publicly, framing this era as a major opportunity to reshape how the category works. Why does that matter for net worth? Because the leaders who sit at the center of a category shift often get paid well, and they often gain new deal opportunities as their visibility increases again.

Even if you ignore the executive compensation side, the positioning itself is valuable. It keeps his name linked to the future, not just the past. And “future relevance” is the kind of thing that leads to new ventures, advisory roles, board seats, and investment opportunities that can quietly multiply wealth.

Board work and reputation: the quieter money layer

Founders who build a household-name product don’t only get paid through their company. They often get paid through credibility. Board roles, advisory roles, and strategic partnerships can bring in meaningful income and equity exposure without the founder having to operate day-to-day.

Siminoff served on the board of Jabil, a major manufacturing services company, and reports indicate he planned not to seek re-election at the 2026 annual meeting. Even without assigning a specific dollar amount to board compensation, the presence of that kind of board seat tells you how the business world views him: as someone with operational and product experience valuable at scale.

That credibility is a financial asset. It increases deal flow. It creates access. And access is how wealthy founders keep getting wealthier.

How his net worth is likely structured

Because so much of this is private, the most honest way to describe his balance sheet is by categories, not pretend precision. A founder at this level typically holds wealth in a mix like this:

- Cash and liquid investments from the acquisition and ongoing compensation

- Public market exposure through diversified portfolios and funds

- Private investments in startups (either as an angel or through venture relationships)

- Real estate in high-value markets (common for founders who want stable asset storage)

- Equity-based upside tied to newer ventures, advisory work, or executive packages

In other words, his net worth is not just “Ring money.” It’s Ring money that likely got invested, stabilized, diversified, and layered with second-act opportunities.

Why different websites publish wildly different numbers

If you’ve seen estimates that jump all over the place, that’s normal for founders. Here’s why:

- Ring’s sale price was widely reported, but Siminoff’s exact stake isn’t fully public.

- Private deal terms stay private. Retention and incentive packages are rarely disclosed in detail.

- Some sites inflate for clicks. They treat “sold for $1B” as “founder is a billionaire,” which is usually wrong.

- Others underestimate by ignoring equity reality. They treat founders like salaried employees, which also misses the point.

The steady middle—around $300 million, with a broader $300–$400 million range—fits the best-known facts without pretending to know what’s inside his private brokerage account.

The bottom line

Estimated Jamie Siminoff net worth in 2026 is about $300 million, with many public estimates placing him in a $300–$400 million range. He earned that position by building Ring from a risky hardware idea into a household name, selling it to Amazon for a reported billion-dollar price, and then continuing to play offense: launching new ventures, staying visible in the smart home space, and returning to Amazon to lead the next evolution of home security.

That’s why his wealth feels durable. It isn’t built on one lucky moment. It’s built on a pattern: spot a category, build the product, survive the ugly middle, and keep moving even after the win.

image source: https://www.geekwire.com/2025/too-dumb-to-fail-ring-founder-jamie-siminoff-promises-gritty-startup-lessons-in-upcoming-book/