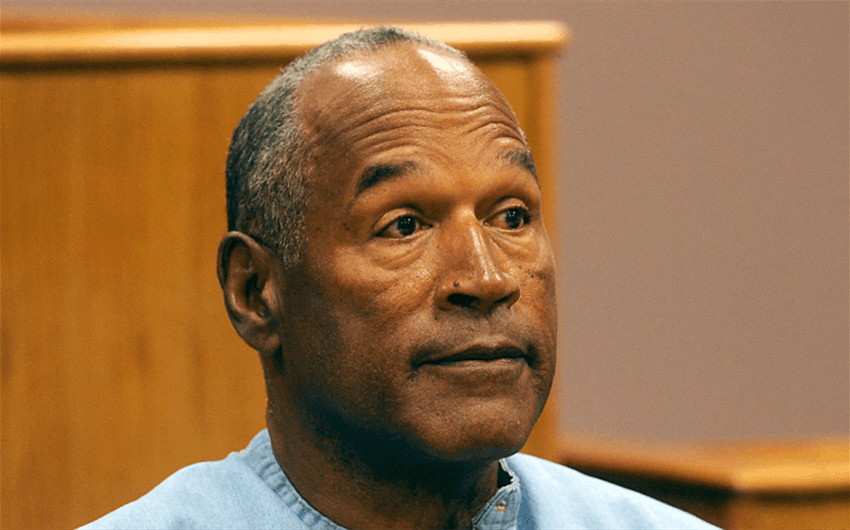

OJ Simpson Net Worth in 2026: Estate Value, Debts, and Hidden Assets

If you’re looking up OJ Simpson net worth, you’re not just asking about a number. You’re asking how someone who once had superstar money ended up with an estate described as relatively modest, while still leaving behind decades of legal and financial fallout. The short answer is that O.J. Simpson’s net worth was widely reported around $3 million near the end of his life, but the more meaningful figure in 2026 is what his estate could realistically pay out after expenses, taxes, and creditor claims—often described as closer to the $500,000 to $1 million range in probate discussions. The details matter, because this is one of the clearest examples of how fame, income, lawsuits, and asset protection can collide.

What was OJ Simpson’s net worth, and why do the numbers conflict?

Most celebrity net worth estimates are educated guesses, and O.J. Simpson’s case is especially tricky. For years, many public-facing estimates hovered in the low millions. After his death in April 2024, it was commonly reported that his net worth was around $3 million. But later reporting around the probate process suggested that the value of his estate—what’s actually available to distribute after administrative costs and taxes—could be significantly lower, sometimes discussed as $500,000 to $1 million.

That difference isn’t unusual in an estate situation. “Net worth” is a broad snapshot: assets minus liabilities, often estimated without full access to private documents. An “estate value” in probate is narrower and more practical: what property is in the estate, what is exempt, what is already spoken for, what is owed to the IRS, and what remains after fees and legal processes. In other words, a celebrity can be “worth” a certain amount on paper, yet have far less available for creditors once the real-world process begins.

Why OJ Simpson still had money after the civil judgment

A big reason this topic keeps resurfacing is the civil case. In 1997, Simpson was found liable in a wrongful death civil trial and ordered to pay $33.5 million to the victims’ families. Interest and time caused that amount to grow dramatically. Yet for decades, the judgment was largely unpaid.

How is that even possible?

The key is that not all income and assets can be reached the same way. Certain types of income, particularly some pensions, can be difficult for judgment creditors to attach depending on state law and the nature of the plan. Additionally, Simpson lived in Florida for a period, where homestead protections are famously strong. Florida’s homestead exemption can protect a primary residence from many creditor claims, meaning a home can be off-limits even when a massive judgment exists.

This is one of the most important “money lessons” in the entire O.J. story: being ordered to pay is not always the same as creditors being able to collect, especially when the debtor’s assets are structured in protected categories.

The probate headline: the Goldman claim and what “agreed to pay” really means

In the years after Simpson’s death, probate reporting made clear how large the outstanding claims still were. The Goldman family’s claim in probate was discussed in the tens of millions, reflecting decades of interest and unpaid judgment amounts. News coverage described Simpson’s estate accepting a claim around $58 million connected to Ron Goldman’s father, but that acceptance does not automatically mean a $58 million check is coming. In probate terms, accepting a claim often means the estate is acknowledging the debt’s validity to move the legal process forward. Actual payment depends on what money is available in the estate after higher-priority obligations and administrative costs.

Put simply: a claim can be enormous while the estate is small. That’s why multiple reports framed any eventual payout as likely only a fraction of what’s owed.

What assets might have been in OJ Simpson’s estate?

When people imagine “celebrity estates,” they picture mansions, massive investment accounts, and luxury collections. O.J. Simpson’s estate appears to have been more complicated and less glamorous than many assume, especially after decades of legal battles, changing living arrangements, and expenses.

While the full inventory in probate is typically handled through legal filings and estate administration, the types of assets that are often discussed in cases like this include:

- Personal property (memorabilia, collectibles, jewelry, and household items)

- Bank accounts (whatever cash remained accessible and in his name or estate structures)

- Royalties (if any were still payable and not protected or already assigned)

- Vehicles and other titled assets

- Residual income streams connected to older entertainment or sports-related arrangements

One theme that came up in coverage is that certain items from Simpson’s estate were expected to be auctioned to raise money. That’s a common probate move when creditors exist and there isn’t enough liquid cash. Auctions convert belongings into funds that can be used for taxes, administration costs, and partial creditor payments.

The protected-income issue: pensions and why creditors can hit a wall

O.J. Simpson had a long public career: NFL superstar, pitchman, actor, and broadcaster. Over a life like that, it’s common to have retirement income streams. Certain pensions—depending on how they are structured and what laws apply—can be protected from creditor collection.

That’s one reason reporting repeatedly referenced the idea that Simpson lived for years relying heavily on pension income, while the civil judgment remained largely uncollected. Even when someone is not living lavishly, steady protected income can support a comfortable lifestyle without providing creditors an easy way to seize it.

This is also why probate becomes such a big deal after death: some protections change, some assets become collectible, and creditors often have a clearer path to whatever is truly in the estate.

How OJ Simpson made money before everything collapsed

To understand OJ Simpson net worth, you have to remember just how big his earning power once was. He wasn’t a niche athlete. He was a cultural figure.

1) NFL stardom and early financial leverage

Simpson entered professional football at a time when salaries were far smaller than modern NFL money, but he was still a major star with unusual negotiating power for the era. He was a headline-making player, and his name carried national recognition.

Even if the raw salary numbers look “small” compared to today’s contracts, the important point is that being a superstar in that era opened doors that mattered more than the game checks: endorsements, media work, and long-term celebrity status.

2) Endorsements and the Hertz era

For many people, the first image that comes to mind isn’t even football—it’s O.J. running through airports in Hertz commercials. He became one of the most recognizable advertising faces of the 1970s and 1980s. Brand deals like that can be extremely lucrative because they don’t just pay once. They pay over a campaign period, and they elevate the celebrity into a mainstream household name.

Endorsements also matter because they expand a person’s “earning identity.” An athlete who becomes a national spokesperson can often command higher fees across many opportunities afterward—speaking engagements, appearances, and media roles.

3) Acting and entertainment income

Simpson also worked as an actor, appearing in major projects and becoming widely remembered for comedic roles later on. Acting income can be meaningful, but its bigger value is how it extends fame into new audiences. More audiences usually means more marketability, and marketability creates more paid opportunities.

4) Broadcasting and media visibility

Sports broadcasting can provide steady, high-paying work for a famous former athlete. While details of individual contracts are usually private, the general principle is clear: being a recognizable sports icon creates a strong post-retirement income path.

The financial damage: legal fees, settlements, and long-term consequences

People often ask why O.J. Simpson wasn’t worth far more, given how famous he was. The simplest answer is that legal trouble is expensive in ways most people can’t imagine.

Consider the likely long-term money drains that shaped his net worth:

- Defense costs tied to years of legal representation and case-related expenses

- Civil litigation exposure including ongoing enforcement attempts

- Reputation collapse which dramatically reduces endorsement potential and mainstream media opportunities

- Life disruption that makes stable earning years harder to maintain

Even for wealthy people, decades of legal pressure can change everything. And beyond the money, there is the simple reality that many major companies do not want brand association with controversy—meaning the endorsement pipeline that once created large income disappears.

The Las Vegas robbery case and how prison changes finances

Another major factor in Simpson’s later-life finances was the 2007 Las Vegas incident involving sports memorabilia, which led to a conviction and a prison sentence. He ultimately served about nine years and was released in 2017, with parole ending later.

From a net worth standpoint, prison creates obvious financial disruption:

- Lost earning time during years when a public figure might otherwise generate income

- Legal costs tied to defense and appeals

- Reduced business opportunities after release due to reputation damage

- Higher financial pressure because normal life planning becomes more complicated

Even if some protected income continues, prison years are rarely wealth-building years. They are typically survival years or maintenance years.

What happens to OJ Simpson’s money after death?

This is where the story becomes very practical. After death, an estate typically goes through a process that looks something like this:

- Administration costs (executor work, legal fees, court filings)

- Taxes (including any IRS claims or tax obligations)

- Creditor claims (like the Goldman claim and any other outstanding debts)

- Distribution to heirs (only after the above are handled, depending on what remains)

In many probate situations—especially with large creditor claims—heirs may receive far less than the public expects. People hear “celebrity” and imagine generational wealth. But if the estate is small and debts are large, the estate becomes a battle of priorities and percentages.

There is also an emotional layer here: the civil judgment wasn’t only about money. For the families, it represented accountability in a civil context. So even symbolic wins in probate, like an estate formally accepting a claim, can matter regardless of the final payout amount.

So what is the most realistic “OJ Simpson net worth” answer in 2026?

The most realistic answer is that the public “net worth” number—often cited around $3 million near the end of his life—doesn’t tell the full story. In practical probate terms, reporting has suggested the estate’s distributable value could be closer to $500,000 to $1 million after administrative costs and taxes, even while the creditor claims tower far above that.

In other words, the net worth conversation isn’t really about how rich he “was.” It’s about what was collectible, what was protected, what remained at death, and what could be liquidated in probate. That’s why two people can argue about his wealth and both feel correct—because they may be talking about two different definitions of “worth.”

Final thoughts on OJ Simpson net worth

The clearest takeaway from OJ Simpson net worth is that wealth isn’t only about how much you earn. It’s about what you keep, what you protect, what creditors can reach, and how long-term legal fallout can reshape a life financially. O.J. Simpson once had peak-level fame with elite earning potential across sports, ads, and entertainment. But decades of civil liability, reputation collapse, and later criminal conviction created a financial story that became less about building wealth and more about navigating debts, exemptions, and estate realities.

image source: https://www.aetv.com/articles/oj-simpson-legal-issues