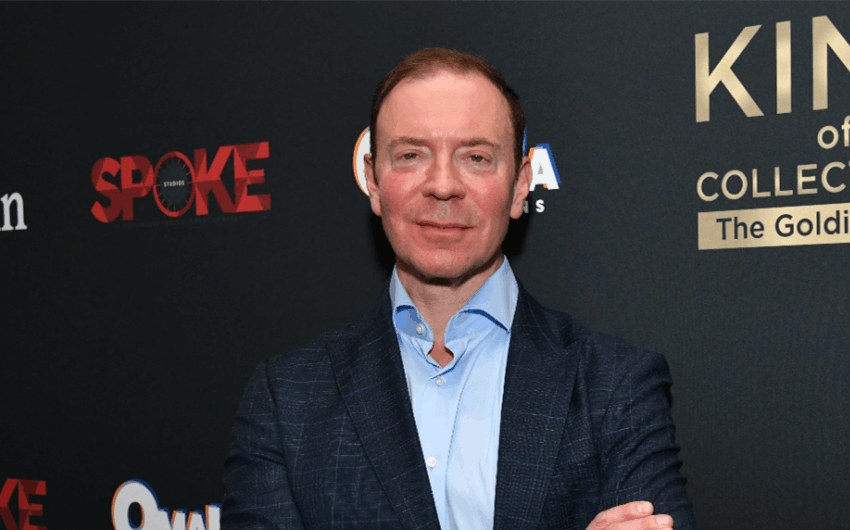

Ken Goldin Net Worth in 2026: The Auction King Behind Goldin Empire

Ken Goldin net worth is a popular search because he’s one of the few people who made trading cards and collectibles feel like Wall Street—fast, public, and high-stakes. The best way to say it clearly is this: his wealth is widely estimated in the $40 million to $60 million range, with a reasonable midpoint estimate of about $50 million. The exact number isn’t public, but the path that created it is easy to track: decades in the hobby, a company built for premium commissions, and a media spotlight that turned his auction house into a mainstream brand.

The quick estimate readers want (and what it really means)

Estimated Ken Goldin net worth in 2026: about $50 million. Treat that as a practical estimate, not a printed bank statement. Goldin hasn’t published a personal financial report, and private-company ownership is never as simple as “the business sold for X, so the founder got X.”

What we can say with confidence is that his fortune is tied to three things: (1) the equity and ongoing role he holds in Goldin, (2) the commission engine that drives high-value auctions, and (3) the brand lift from Netflix, which feeds more consignments, bigger auctions, and more deal flow.

Why Ken Goldin became the face of a booming industry

Ken Goldin didn’t stumble into collectibles during the hype years. He came up through the old-school grind of the card world—buying, selling, learning the psychology of scarcity, and understanding what collectors will pay when emotion meets proof of authenticity.

That long runway matters. In collectibles, trust is everything. When someone hands you a six-figure card or a seven-figure piece of memorabilia, they aren’t just choosing an auction house. They’re choosing a person and a reputation. Goldin built his career on being the guy who knows the difference between a fun story and a truly investment-grade item.

Then the market exploded. The pandemic-era surge pushed trading cards and memorabilia into the mainstream, and Goldin was positioned perfectly: he already had infrastructure, buyer relationships, and a reputation for handling elite items. When demand goes vertical, the people who already have systems win.

Goldin’s business model: why commissions build real wealth

The simplest way to understand Ken Goldin’s wealth is to understand how auction houses make money.

- Seller commissions: The auction house takes a percentage for bringing the item to market and managing the sale.

- Buyer premiums: Buyers often pay an additional fee on top of the winning bid.

- Volume + high price points: The more valuable the items, the more powerful the commission engine becomes.

In other words, Goldin doesn’t need to “own” every million-dollar collectible to profit from million-dollar collectibles. He needs to consistently bring them to auction, create competition, and take his cut as the market clears.

And Goldin has played this game at scale. In 2021, Goldin Auctions was already posting massive sales totals, and the growth was strong enough to attract major ownership changes and outside capital. That’s what real wealth looks like in this niche: you build the trusted marketplace, not just the personal collection.

The ownership shifts that changed the conversation

When people argue about Ken Goldin net worth, they usually miss the biggest clue: Goldin isn’t just a personality—he’s been at the center of major corporate transactions involving his auction business.

Collectors Holdings acquisition in 2021

In July 2021, Collectors Holdings acquired Goldin Auctions, and reporting described the investor group as including high-profile names such as Steve Cohen, Nat Turner, and Dan Sundheim. Goldin remained with the company and continued running it as the public face and operator. That kind of deal usually means two things can be true at once: the founder cashes out some value, and the founder keeps meaningful upside by staying involved.

Founders don’t typically stay in the CEO seat after an acquisition unless the buyer believes the founder is a key asset. In collectibles, the founder often is the brand. Goldin’s name on the door isn’t marketing fluff—it’s part of the product.

eBay deal in 2024

In April 2024, eBay announced an agreement to acquire Goldin from Collectors as part of a broader commercial relationship that tied together marketplaces, authentication, and hobby infrastructure. That matters because it puts Goldin inside a global commerce machine with enormous customer reach.

For a business like Goldin, exposure is oxygen. The more buyers you have, the more valuable consignments you attract. The more valuable consignments you attract, the more sellers trust you with elite items. The flywheel gets faster, and commission revenue grows with it.

When you see those two ownership chapters—Collectors and then eBay—you’re looking at a company that moved from niche powerhouse to mainstream strategic asset. That’s a strong signal that the founder’s wealth is substantial, even if the exact personal figure stays private.

Netflix made him famous, but it also made the business bigger

Ken Goldin became dramatically more recognizable after Netflix’s King of Collectibles: The Goldin Touch launched. Netflix describes the show as following Goldin and his team inside a leading auction house focused on high-end collectibles. The series didn’t just give the hobby more attention. It turned Goldin into the hobby’s most visible salesperson.

That visibility has direct business value:

- More inbound consignments: Owners who were on the fence now have a reason to call.

- More buyers paying attention: New eyeballs mean more bidding competition.

- Higher perceived trust: Television exposure can act like credibility, especially for newer collectors.

Even if Ken Goldin never earned a dollar directly from Netflix (and he almost certainly did in some form), the bigger payoff is what the show does to the funnel. In the auction world, attention turns into inventory, and inventory turns into commission.

How Ken Goldin’s net worth is likely built in real life

When you strip away internet guesswork, his wealth probably comes from a handful of straightforward buckets.

1) Equity value and deal outcomes

The biggest driver is likely equity in Goldin through various ownership stages. Even if he sold a chunk in 2021, founders often keep stakes, performance incentives, or other upside tied to growth. A founder who stays central can benefit multiple times as the company’s ownership changes and its strategic value rises.

2) Executive income and performance pay

Running a high-profile company inside a booming market can pay extremely well. CEO compensation packages often include salary, bonuses, and sometimes equity-linked incentives—especially when a company is scaling or integrating with a larger parent.

3) Media and brand partnerships

Once a founder becomes a recognizable TV personality, additional deals show up: speaking, appearances, partnerships, and brand opportunities connected to the collectibles space. These can be meaningful, but they’re usually smaller than equity value. Think of them as strong “extra lanes,” not the core.

4) Personal collection and long-term holdings

Ken Goldin is also a collector. And for top collectors, personal inventory can become a significant asset over time. The difference is that personal collections are hard to price publicly. They are only “worth” a number when sold, and collectors often hold items because they believe value will grow.

Why net worth estimates for Ken Goldin vary so widely online

It’s normal to see wildly different numbers for someone like Goldin, and it happens for predictable reasons.

- Private deal terms aren’t fully public: Without exact sale prices and ownership percentages, websites guess.

- People confuse company value with personal wealth: A business can be worth a lot while the founder’s personal slice is far smaller—or structured differently.

- Collectibles wealth is hard to verify: Collections are private, values fluctuate, and some assets aren’t liquid.

- Media attention inflates assumptions: When someone looks “everywhere,” people assume “billionaire.” That’s rarely accurate.

This is why the most honest approach is a grounded range. An estimate in the $40–$60 million band fits the available signals: a founder running a major auction marketplace through two major ownership eras, benefiting from a commission-heavy model, and turning media exposure into business scale.

The bigger takeaway: his wealth is tied to the market staying hot

Ken Goldin’s fortune is strongly linked to the health of the premium collectibles market. When high-end items keep changing hands, an auction house thrives. When the market cools, commissions can shrink and inventory can tighten.

But Goldin has a built-in advantage: top-tier items don’t behave like mid-tier items. Even in softer markets, truly rare, culturally iconic pieces can still command strong bids because elite collectors and investors treat them differently. The “best of the best” tends to remain liquid longer than the rest of the market.

That’s why Goldin’s positioning is so powerful. He has built a reputation for handling the top end of the hobby—exactly where the money stays most resilient.

Bottom line

Estimated Ken Goldin net worth in 2026: about $50 million, with a reasonable public-estimate range of $40 million to $60 million. He built it the old-fashioned way for a modern market: decades of credibility, a commission-driven auction platform, and a brand strong enough to survive ownership changes and thrive under bigger corporate umbrellas. Love him or not, the results are clear—Ken Goldin didn’t just ride the collectibles boom. He helped professionalize it, scale it, and sell it to the world.

image source: https://observer.com/2023/04/ken-goldin-covid-collectibles/